Duntrade network

Become a DunTrade partner: get free insight into payment behavior

We give DunTrade Partners additional insights for their credit risk management.

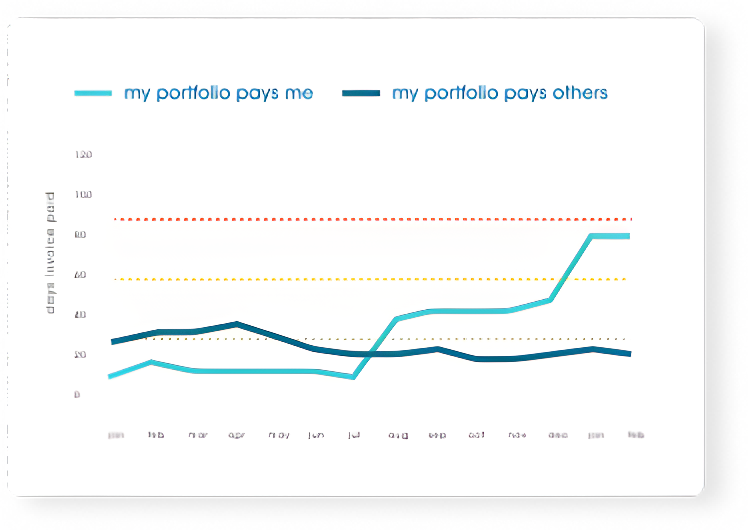

- Benchmark customer and supplier payment behavior

- Identify slow payers and intervene in a timely manner

- Lower your DSO and improve your cash flow

This is how duntrade works

How does the DunTrade® program work?

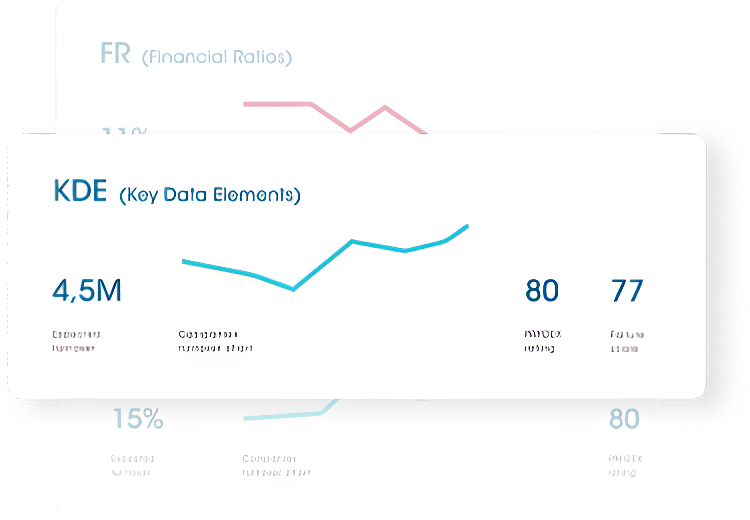

Each month, we collect payment information from more than 15,000 organizations worldwide through an anonymized process. This data enriches our Dun & Bradstreet Data Cloud with up-to-date payment insights from millions of organizations worldwide.

Strictly confidential exchange of data

The exchange is anonymous, strictly confidential and it complies with GDPR and AVG guidelines. As a DunTrade Partner, you receive free access to our comparative payment analytics that help you make better credit and collection decisions.

Benefits

The exclusive benefits for DunTrade partners

As a DunTrade partner, you benefit from unique insights into payment behavior, risk trends and benchmarks that help you mitigate risk, optimize cash flow and better inform strategic decisions.

Benchmark new customers

Also discover how existing customers pay your company compared to other suppliers. The insights into the payment behavior of companies within the same business group or industry give you a strong negotiating position when setting payment terms.

Proactive action on payment risks

The data allows you to identify impending bankruptcies up to 24 months in advance. With this strategic edge, you can start the conversation early, adjust payment terms or take other risk mitigation measures.

Accurate risk score

Credit managers make informed decisions about credit limits, payment terms and accepting new business based on the PAYDEX® score. The immediate result: fewer defaults, lower credit losses and healthier cash flow for your organization.

Results of participants

75% reduction in bad debts in 2-3 years

65% reduction in blocked accounts

Halving average debt per account

75% reduction in bad debts in 2-3 years

65% reduction in blocked accounts

Halving average debt per account

THE BEST INSIGHT THANKS TO THE BEST DATA

Become a DunTrade partner in 4 steps

As a DunTrade partner, you will provide monthly anonymous payment data and contribute to the enrichment of the global Altares D&B Data Cloud. In return, you will receive exclusive insights into the payment behavior of your customers. Discover how easy participating is - in four steps.

1. Contact us

We explain how the DunTrade® program helps your organization and how to securely share data with us.

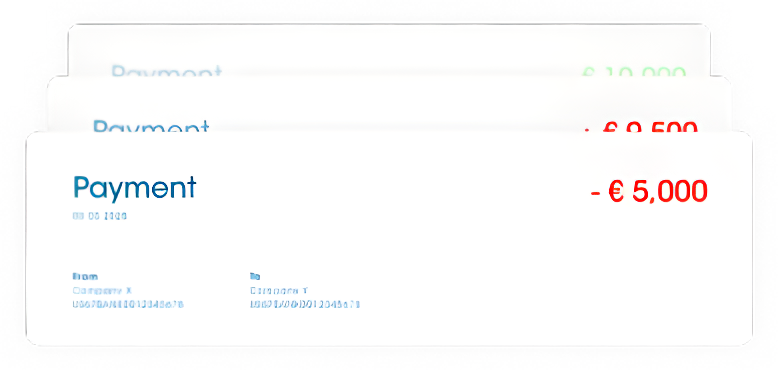

2. Share monthly payment information

Automatically provide your aging balance or list of open items, including a customer list for identification. The first time, our experts first review the data and provide you with a sample report. Only after your approval will we start processing your data in the Dun & Bradstreet Data Cloud.

3. Data processing and enrichment

Within days, the data is anonymously processed in our Payment Performance Insights (PPI) system and enriched with our own data on millions of organizations worldwide.

4. Free access to our partner platform

Receive insight into the payment behavior of your customers and suppliers. Benchmark and monitor them so you can act proactively in case of (future) payment problems.

Become a partner

Strengthen your credit risk management as a DunTrade partner

Get unique insights into the payment behavior of your customers and suppliers by joining Dun & Bradstreet's DunTrade® program at no cost.

deeper insight

Related articles

We are curious and love to share our findings. Read the latest blog posts related to the DunTrade® program here.

How do you implement credit risk screening in your organization?

How to go from huge numbers of data to a single credit score?

Three benefits of monitoring credit risk

Questions & Answers

FAQ about the DunTrade® program

No way, the DunTrade® program was developed for every company in the world because it is a valuable addition to credit risk management services.

Altares Dun & Bradstreed customers can also seamlessly integrate the DunTrade® program with their purchased solutions to create an even more complete picture of customers, suppliers and business partners.

By participating in the program, you contribute to the quality and reliability of the PAYDEX® scores you use for your own decision-making, while gaining valuable additional insights into your own customers' payment behavior.

Absolutely. The DunTrade® program guarantees complete anonymity. The identity of information providers is never released. And other participants can only see payment trends, but never actual payment details or company information.

Data processing is fully automated and secure. You can share your payment information by providing a monthly aging balance or list of open items, along with a customer list for identification. After initial setup, this requires minimal effort on your part. Contact us for a detailed explanation of the process.

Related Matters

What can we help you with?

Unlock deeper insights and optimize decision making with other additional tools and features we offer.

Be able to assess risk with prospects

Is there a promising lead? Use our reliable company information and credit risk data to decide whether to accept him as a client and under what conditions, and avoid financial risk.

Map your market and market potential

Understanding your market is critical to success. The Dun & Bradstreet Data Cloud provides comprehensive analysis, insight into market share and market penetration, and discovers growth opportunities through quick, simple business counts.

Integrate Dun & Bradstreet data seamlessly into your ERP system

Integrate our rich database into your ERP system for clean data, instant validation and enrichment of customer information, and improve your underwriting process and scoring model with up-to-date data.

Identify stakeholders (UBO) of complex organizations

Almost 70% of Dutch private limited companies are linked to other companies through shares. The Dun & Bradstreet Data Cloud provides a complete overview of these relationships, from small companies to large multinationals.

Get full insight into ESG performance with D&B ESG Platform

Establishing business relationships with ethical companies is one of the growing priorities of companies to mitigate risk, increase resilience and improve business performance.